On January 27, the MMD Research Institute published the results of a survey of six major services of smartphone QR settlement in January 2022.According to this, PayPay was the most frequently used, and about 60 % of users use it at least once a week.

This survey was the subject of PayPay, D payment, Rakuten Pay, au Pay, Melpei, and LINE Pay.We are asking 150 users who use these services mainly about the frequency of use and satisfaction.

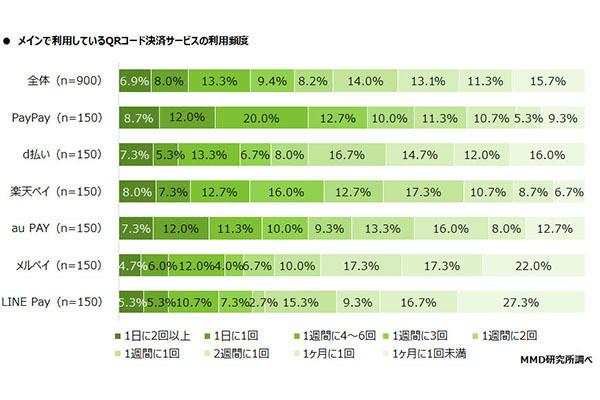

The frequency of use of each service was high for users who mainly use PayPay.Looking at the ratio of heavy users to be used twice a day, the top PayPay is 8.7 %, 2nd Rakuten Pay 8.0 %, 3rd place is au Pay and D payment 7.3 %.Looking at the frequency of use below, the trend does not seem to change in general.

When asked about the satisfaction of the services used in the main, Rakuten Pay is the top overall satisfaction / profit section.PayPay in the convenience sector, au Pay in the trust section, and Melpei in the app design category.It is a convincing result that PayPay, which was the most commonly used in the previous question, is evaluated for convenience.

D payment / LINE Pay seems to be struggling without the top division, but the D -payment is still a certain number of users reflect the share of docomo.The LINE Pay is not a rating because the integration of the same SoftBank PayPay is not evaluated.

Regarding the customer recommendation of each service (how much do you want to recommend to your family and friends), the result is 1st PayPay, 2nd Rakuten Pay, 3rd place D payment.There was no big gap from the frequency of use.

According to individual comments, PayPay's advantages are "Because there are many shops that can be used overwhelmingly than other cashless payments" "I earn points and do a lot of great campaigns rather than paying in cash."There was a voice saying, "The point redemption rate is very low" and "If you are not a SoftBank user, there is no particular reason to recommend it."

Regarding Rakuten Pay, recommended comments such as "It is good to be able to actively use a small shopping that is hesitant to use a credit card" and "It is better to use the points earned at the online shop at real stores".There were negative comments, such as a system that I like, but not as much as I would recommend to others, "and" I can't say it unless I am in the Rakuten economic zone. "

Overall, the reason why each service is not recommended to the family and acquaintances is that the advantages / disadvantages vary greatly depending on the smartphone line contract and point service that the other party is using.

In the first place, I started using QR code payments in the first place, because "I accumulate a lot of points"..At 3 %, "Because I was interested in knowing the campaign" 24.9 %, "Because the service and points that I usually use are linked" 22.Continue to 2 %.All of the top three items are due to "focus", and it can be said that the tricks are more attractive than convenience.

Also, if you look at the reasons for starting to use for each service, you can see each trend.Merpay is the lower ranking of "accumulating a lot of points", and when "the service and points that I usually use are linked" is the first place, the center of the user is Mercari's heavy user.No, so.In addition, PayPay is the top of "I was interested in knowing the campaign", and it can be seen that the fact that I have been actively working on customers from the start of the service has led to the top use.