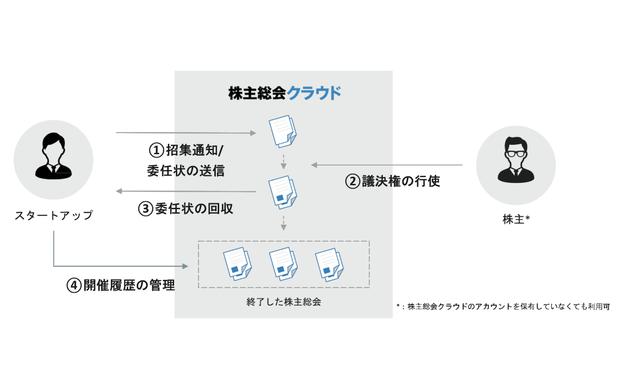

On the 1st, Kepple launched beta of SaaS "Shareholders' Meeting Cloud" that can complete convocation notices, proxy collections, and holding histories online at the holding of shareholders' meetings of unlisted companies such as startups. It supports the efficient operation of back-office operations around the general meeting of shareholders, which have hitherto been carried out by mail or on paper.

It is rare for a general meeting of shareholders of a non-listed company, including startups, to be held with the attendance of many shareholders. In many cases, the initial investors who supported them delegated resolutions and managed them. In 2002, the Commercial Code was amended to introduce a system of electronic provision based on prior individual consent, but in reality only a few percent of convocation notices are issued by electromagnetic means.

Because the general meeting of shareholders cannot be completed online, even though the general meeting of shareholders itself can be done online with Zoom, preparations and management before and after the general meeting of shareholders, including printing, binding, and sending convocation notices, are online. Kepple thought that there was a situation where it was not done, and came to develop a shareholder meeting cloud. We aim to solve the problems of indirect cost expansion, business delays, and complicated history management for unlisted companies including startups.

Kepple was founded in 2015 by Takahiro Kanzaki, a certified public accountant and tax accountant. Based on Mr. Kamisaki's knowledge of accounting, tax advice, and funding support for startups, he has provided "KEPPLE ACADEMY", a study group and community, and "FUNDBOARD", a stock management tool for unlisted companies. there is FUNDBOARD has many independent VCs and CVCs as customers, and the voices of their worries have become a tailwind for this new SaaS development.

FUNDBOARD users include VCs that have invested in hundreds of companies, and they receive convocation notices from dozens of startups almost every month.

However, in unlisted companies, there are many places where it ends after collecting the power of attorney from the shareholders. This procedure was taken in order to comply with the Companies Act, but for small companies, the administrative work required a lot of effort. (Mr. Kasaki)

The general meeting of shareholders cloud is expected to be provided on a subscription model. Although it depends on the company's business year, shareholders' meetings are held only once or twice a year at most, so the frequency of use is low outside of the time when shareholders' meetings are held. In order to constantly increase user engagement, Kepple has implemented IR elements such as a history management function for past shareholders' meetings in the shareholders' meeting cloud. .

Kepple has so far received 30 million yen from four individual investors in April 2018, 270 million yen from Nihon Keizai Shimbun, etc. in December 2018, and in March 2019 Nomura Investor It has raised 80 million yen from Nomura Research Institute (TSE: 4307), which has Relations and others.

In the area of streamlining shareholder meetings, Proxymity, a London-based proxy voting platform for investors spun off from financial giant Citi, raised US$20.5 million from financial firms last month. In Japan, Bizer (acquired by PERSOL PROCESS & TECHNOLOGY last year), which streamlines back-office operations, announced “BizerIR” in 2017, which enables online shareholder-related operations.

BRIDGE operates a membership system "BRIDGE Members". BRIDGE Tokyo, a community for members, provides a place to connect startups and readers through tech news, trend information, Discord, and events. Registration is free.