Smartphones in the 20,000 yen range are suddenly increasing their presence. In mid-January, Sharp launched "AQUOS wish," which puts the SDGs on all fronts. In addition to au adopting it for consumers, Softbank will also introduce the same model as a corporate terminal. FCNT also delivered "arrows We", which can be purchased for the first half of the 20,000 yen range to three carriers. Samsung Electronics' "Galaxy A22 5G" released by DoCoMo on December 2 is also a smartphone in the low 20,000 yen range.

Likewise, Sony, which introduced the entry model "Xperia Ace II" to Docomo, saw a sharp increase in market share in the first half of the year. It surpassed Sharp, which had the top share of Android smartphones, by a small margin, and jumped to the top. Behind the expansion of entry models one after another by each company is the influence of the revision of the Telecommunications Business Law and the cessation of 3G waves. It seems that a new market is expanding following the middle-range model of about 30,000 yen to 40,000 yen. We want to keep up with such market trends.

The market for smartphones in the 20,000 yen range is expanding rapidly. Softbank will release Xiaomi's exclusive model "Redmi Note 9T" in February 2021. Docomo also launched Sony's Xperia Ace II in May in a form that counteracts these moves. FCNT's arrows We, which is released by three carriers, is also in the low 20,000 yen range. Not only are carriers expanding their lineup of smartphones, but sales are also strong. In particular, the Xperia Ace II was often placed at the top of sales rankings, contributing to the expansion of Sony's market share.

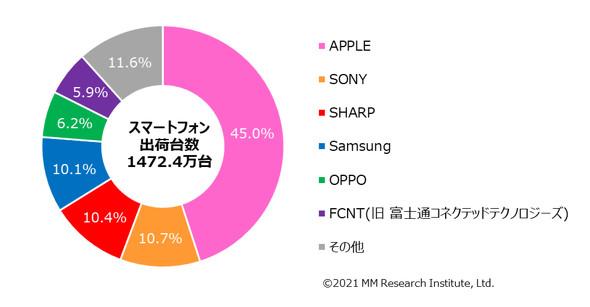

In the first half of the year, Sony jumped to number one, surpassing Sharp, which had long reigned as the top Android smartphone manufacturer. According to the shipment survey for the first half of 2021 (April to September) announced by MM Research Institute, Sony won a share of 10.7%. In smartphones, it ranks second after Apple. Sony has released the mid-range "Xperia 10 III" and the flagship model "Xperia 1 III", and although it has not been possible to capture the market share so far with a single model, shipments have increased significantly compared to the previous year. The reason is that the entry model has a big influence.

Market share by manufacturer in the first half of FY2021 announced by MM Research Institute. Sharp, which was the top Android smartphone maker, fell to second place. Instead, Sony took the top spot.Samsung also released the Galaxy A22 5G, which can be said to be a Docomo exclusive model, in December to counter this trend. The Galaxy A22 5G is a terminal targeting users who switch from feature phones to smartphones and children who have mobile phones for the first time. It supports waterproof / dustproof (dust) and Osaifu-Keitai, and also has a simple mode. There are terminals with the model number Galaxy A22 globally, but the docomo version is a Japanese-only model that further drops the specs. This is also to realize a reasonable price of 22,000 yen.

Samsung's Galaxy A22 5G, which DoCoMo released in December, is also very cheap at 22,000 yenMid-range models are fully entering the entry-level smartphone market. Sharp, whose AQUOS sense series is very popular. As mentioned at the beginning, the company will release AQUOS wish in mid-January. The AQUOS wish uses recycled plastic for its body, and its packaging is simplified to make it easier to recycle. The specs are even lower than middle-range models such as AQUOS sense, but it also supports 5G while properly supporting Japanese specifications such as waterproof / dustproof and Osaifu-Keitai.

Sharp's AQUOS wish is the entry model of the AQUOS series.The price of the AQUOS wish has not yet been announced, but the specs are close to the 20,000 yen model mentioned above, and the 2 It is highly likely that it will be sold in the 10,000 yen range. The entry model has to cut off the specifications because the price is cheap. Therefore, compared to terminals that can spend a lot of money on hardware, it is difficult to show the manufacturer's "color". It can be said that Sharp launched the SDGs on the front in order to differentiate itself not by function but by concept.

In addition, Xiaomi's Japan-only model "Redmi Note 10 JE" jointly developed with KDDI, OPPO's "OPPO A54 5G" and "OPPO A55s 5G" are sold in the high 20,000 yen range. . Originally, the Japanese smartphone market was centered on high-end models, but especially since 2019, the proportion of middle-range models has increased rapidly. Furthermore, recently, it can be seen that entry models with reduced specifications that can be purchased at the 20,000 yen level are becoming established in the market.